Version française - Versión española

This article is the first of a two-part series that recounts a study tour’s excellent learning experience.

2024 is already a memorable year for Côte d’Ivoire. The country won the Africa Cup of Nations in February, and four experts from the debt management office (DMO) of Côte d’Ivoire visited Brazil, a 5-time world cup champion, from 20 to 29 February 2024, to learn from their experience in debt management.

The DMFAS Programme is grateful to the Brazilian debt management office for hosting the delegation and praises the work of all participants, Brazilians and Ivoirians, for their outstanding expertise, openness and professionalism.

Background

The study tour took place within the context of an ongoing reorganization of the MoF’s departments in Cote d’Ivoire, which resulted in the newly created General Directorate of Financing (Direction Générale des Financements - DGF). The DGF seeks to centralize all units including the Treasury into a cohesive structure to include broader debt and cash management (e.g. managing PPPs and interfacing debt management with the future treasury IT system under development). New tools for cash and treasury management will be adopted to support the process.

The study tour took place within the context of an ongoing reorganization of the MoF’s departments in Cote d’Ivoire, which resulted in the newly created General Directorate of Financing (Direction Générale des Financements - DGF). The DGF seeks to centralize all units including the Treasury into a cohesive structure to include broader debt and cash management (e.g. managing PPPs and interfacing debt management with the future treasury IT system under development). New tools for cash and treasury management will be adopted to support the process.

As a country that underwent many technological and institutional changes that resulted in a modernized DMO well integrated into the MoF’s IFMIS system, Brazil was deemed a relevant counterpart for Côte d’Ivoire to trade experiences, successes and challenges with. Brazil and Côte d’Ivoire have sizable debt portfolios within their own regions which sets the stage for a meaningful sharing of experiences. Brazil has successfully created and integrated its own debt and cash management systems to manage a nearly trillion-dollar debt portfolio, one of the largest portfolios in Latin American. Though the Brazilian DMO is very similar to debt offices of advanced economies, it still faces several hurdles that developing countries must tackle.

During the study tour, the Ivoirian delegation was particularly interested in learning more about the organization of the debt office and in the integration of the different financial management systems.

Organization of the Brazilian DMO

A new era began in the early 2000’s in the area of debt management in Brazil with the reorganization of the debt office in the front-back-middle office structure, and with the enactment of the law prohibiting the Central Bank to lend money to the Treasury.

The structure of the DMO also incorporates less conventional organizational aspects. For example, a Brazilian specificity is the Debt Management Committee. Originally created as an informal unit, it was later institutionalized to steer the debt office’s operations and planning. Led by the Under Secretary of Debt and composed of front, middle and back offices its objective is to discuss and present the best available strategic options to decision-makers in regard to market development, cash management, short-term and mid-term strategies, auctions risk management, etc.

Systems

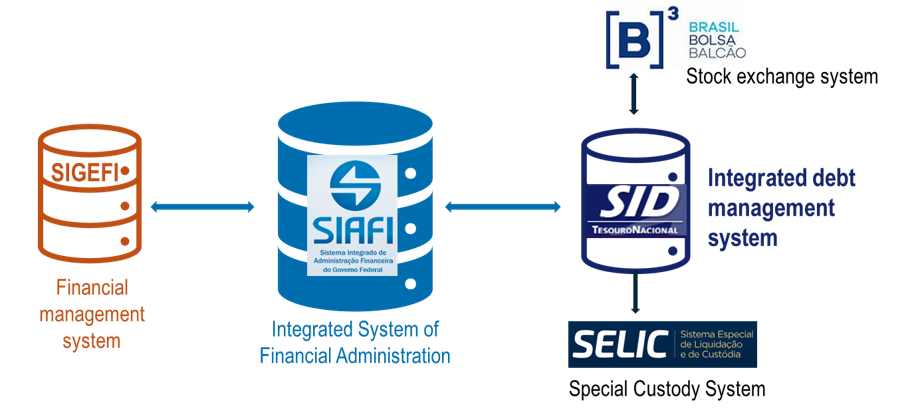

The Ivoirian delegation was also very interested to learn about the integration of the Brazilian debt management system into the broader financial management, which is called Integrated System of Financial Administration (SIAFI). SIAFI is the most important system used by the federal government to manage the single account and related budgetary information and it is linked to a number of systems, including:

The Ivoirian delegation was also very interested to learn about the integration of the Brazilian debt management system into the broader financial management, which is called Integrated System of Financial Administration (SIAFI). SIAFI is the most important system used by the federal government to manage the single account and related budgetary information and it is linked to a number of systems, including:

- the web-based debt system called SID (Integrated Debt System). SID is used for debt management operations, as well as reporting and generating statistical and analytical information. The SID is also integrated with the stock exchange system (B3) and SELIC, the Central Bank Special Custody System, hence optimizing the time and accuracy of all financial operations regarding auction, purchase or repurchase of securities.

- the SIGEFI (Financial Management System), which is a modern system providing government entities with consolidated data for managing payment schedules and controlling budgetary limits, etc.

Today, the Brazil debt management system has become mature and is part of a symbiotic integrated financial system. All systems form a cloud that debt officers can access from home to perform all debt related operations with security guarantees.

After 2 weeks of an intensive sharing of experience, the Ivoirian debt officers gained valuable insights to nurture the ongoing reorganization process. The study tour was also a time for building relationships as the Brazilian and Ivoirians debt officers expressed strong interest in continuing exchanging experience. UNCTAD will help strengthen the dialogue between countries.

More insights on this study tour will be shared in the next newsletter, in particular on the borrowing plan, management of instruments and reporting aspects, including investor relations.